Jim Cramer watched as the market was roaring strong on Thursday, until about 2 pm Eastern. That's when investor Carl Icahn told CNBC that he sold Apple over concerns of Chinese weakness.

Those comments sent the market plummeting, and Apple lost another 3 percent.

Cramer understood why investors would feel nervous that Icahn doesn't like the iPhone maker anymore. After being such a supporter of the stock, it may have been jarring to hear that he exited his position.

"You have to decide for yourself whether you like a stock or you don't. You have to rely on your own judgment, not Carl Icahn's, when determining whether to love or hate individual companies. It's your money, not his," the "Mad Money" host said.

I think rather than focusing on Icahn likes or dislikes — and I love the guy — we need to focus on what this market wants out of a company.Jim Cramer

So, why not just sell everything?

Cramer reminded investors that there are still plenty of companies that are delivering on their promises. Those investors that sold into Thursday afternoon's weakness would have missed out on strength in LinkedIn, Expedia and especially Amazon—which almost doubled the profits expected.

"I think rather than focusing on Icahn likes or dislikes—and I love the guy—we need to focus on what this market wants out of a company," Cramer said.

Read more from Mad Money with Jim Cramer

Cramer Remix: Facebook's picture-perfect quarter

Cramer: We are looking at Apple all wrong

Cramer: Mini-bull markets driving stocks

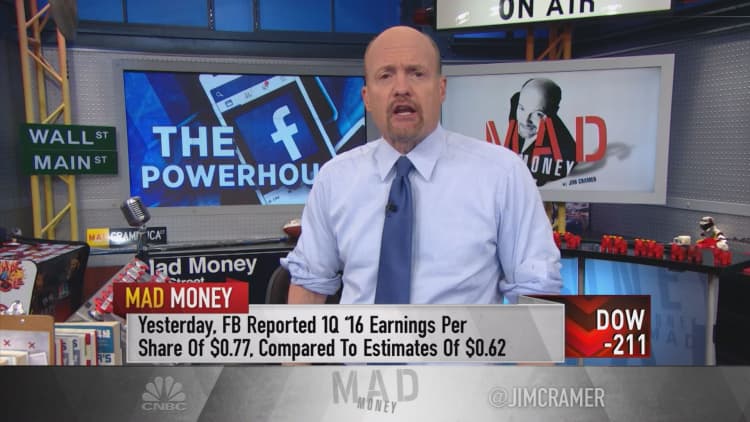

One stock that displayed exactly what a company can do in this environment was Facebook, which soared 7 percent Thursday. In fact, Cramer thinks it should have been up more than it was on Thursday.

The company's revenues were up a staggering 52 percent year-over-year and came in approximately $150 million above analyst consensus.

"The numbers are downright sterile compared to what is really going on at Facebook," Cramer explained.

Cramer added that the magic behind Facebook is that it has managed to transform how people live their lives, and make an impact that most businesses can only dream of. It now has 1.09 billion daily active users that spend around one hour a day on their page, Instagram or messenger.

That is one billion more people who found time to be on a network that didn't exist a dozen years ago.

Facebook grows its gross margins by including more ads, because users create more content. And it's all done on a phone, which Cramer thinks is the real secret, because a phone is always with them.

Ultimately, there is plenty of life left in Facebook, Amazon and LinkedIn.

"Before you throw out everything because one smart man is worried about them ... For all the sturm and drang about tech, the F and the A in FANG look pretty darned good. Two out of four aren't bad! " Cramer said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com